Business Insurance in and around Las Vegas

Calling all small business owners of Las Vegas!

Insure your business, intentionally

Insure The Business You've Built.

As a small business owner, you understand that running a business can be risky. Unfortunately, sometimes accidents like a customer stumbling and falling can happen on your business's property.

Calling all small business owners of Las Vegas!

Insure your business, intentionally

Protect Your Future With State Farm

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like errors and omissions liability or business continuity plans, that can be formed to develop a personalized policy to fit your small business's needs. And when the unexpected does occur, agent Jen Sias-Lyke can also help you file your claim.

Don’t let the unknown about your business keep you up at night! Contact State Farm agent Jen Sias-Lyke today, and learn more about how you can benefit from State Farm small business insurance.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

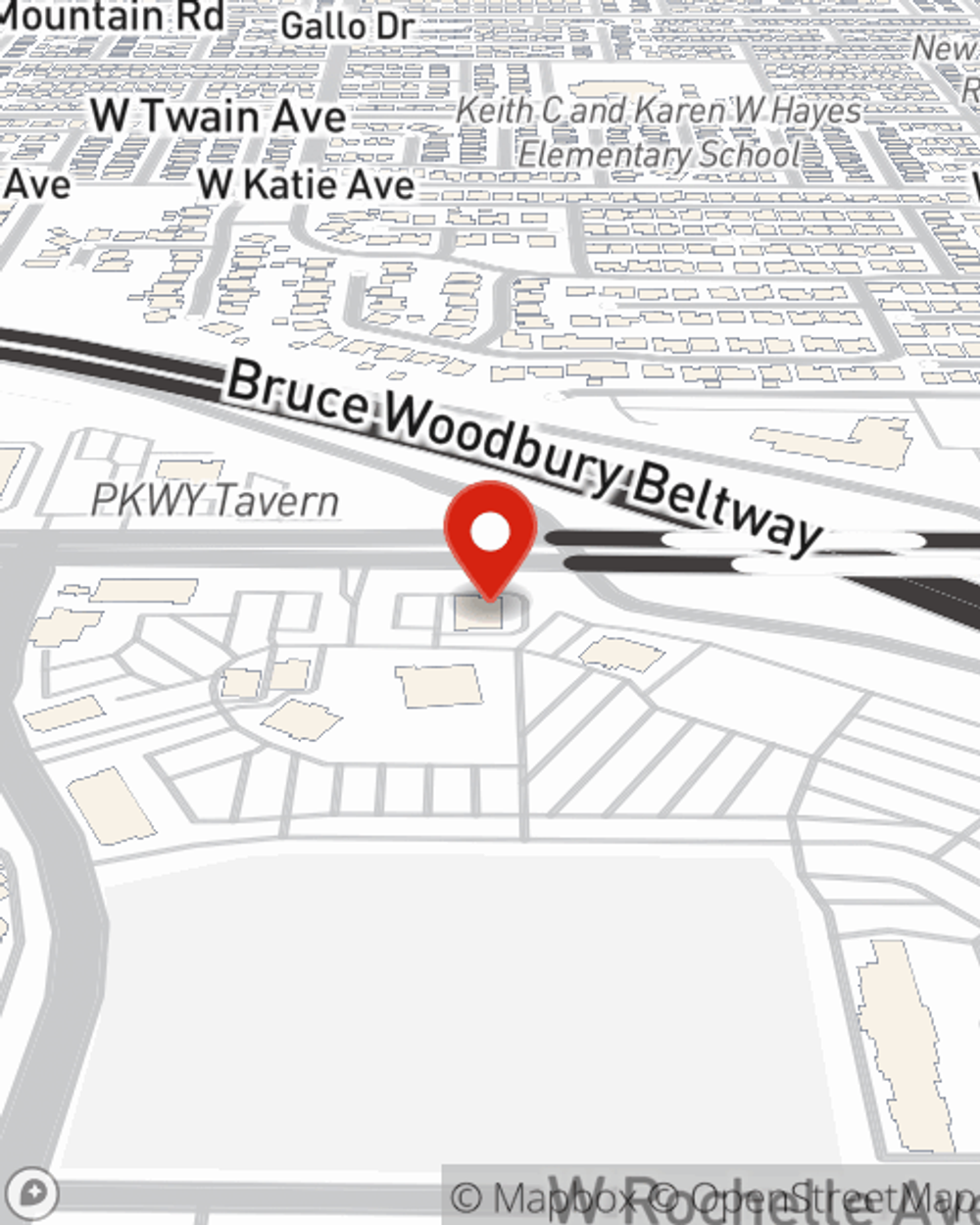

Jen Sias-Lyke

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.